social security tax netherlands

Social Security Administration Research Statistics and Policy Analysis. The table has current values for Social Security Rate previous releases historical highs and record lows release frequency reported unit and currency plus.

Payslip In The Netherlands How Does It Work Blog Parakar

Winnipeg Tax Centre PO Box 14001 Station Main Winnipeg MB R3C 3M3.

. Effective tax rate 33000 total tax divided by 50000 salary 66. The government allows deductions for business expenses social contributions and 80 of alimony payments and there is a personal. The tax system in the Netherlands.

The Federal Insurance Contributions Act is a tax mechanism codified in Title 26 Subtitle C Chapter 21 of the United States Code. Medicare provides hospital insurance benefits for the elderly. Find out about contributions and claims in case of illness pregnancy or unemployment.

If you contributed to a pension plan or social security arrangement in another country see Form RC267 Employee Contributions to a United States Retirement Plan. European Union EU regulations. Most pension systems as.

The European Union EU is a voluntary supranational political economic and monetary union of 27 democratic sovereign member states with social market economies that are located primarily in Europe. Company during the tax year. How to apply as self-employed.

Employee Social Security Tax 7000 Income tax 18000 TOTAL 83000. Social Security was originally a universal tax but when Medicare was passed in 1965 objecting religious groups in existence prior to 1951 were allowed to opt out of the system. Child benefit isnt means tested it is available to anyone covered by social security who has one.

The agreements work by assigning social security coverage and in turn tax liability to only one country as determined by the rules of the particular agreement. Panama Poland Portugal 14. Netherlands Netherlands Antilles New Zealand Norway 13.

The Belastingdienst is responsible for collecting taxes and social security contributions. However a Social Security number is required for parents to claim their children as. The Dutch tax office Belastingdienst is an entity of the Ministry of Finance.

All other regions and countries. Christina Brooks a resident of the Netherlands worked 240 days for a US. These are available to people who live work and pay tax in the Netherlands.

You must have a social security number register as self-employed with the Spanish tax office and register with the Spanish social security system using the form TA0521Find your local office hereTo do this youll need your NIE and passport. The amount that one pays in payroll taxes throughout ones working career is associated indirectly. Citizens living abroad FBAR FATCA must consult an expat tax CPA that provides international tax services.

They automatically enroll you with the various funds that in turn send bills for your contributions. The Internal Revenue Service IRS has received the following frequently asked questions regarding Expatriation Tax Reporting of Foreign Financial Accounts Foreign Earned Income Exclusion Individual Taxpayer Identification Number ITIN Applications and other general international federal tax matters impacting individual taxpayersThe answers to these. Our content on radio web mobile and through social media encourages conversation and the sharing of.

The combined tax rate of these two federal programs is 1530 765 paid by the employee and 765 paid by the employer. Containing 58 per cent of the world population in 2020 the EU generated a nominal gross domestic product GDP of around US171 trillion in 2021 constituting. In 20112012 it temporarily dropped to 1330 565 paid by the employee and 765 paid by the employer.

This page provides values for Social Security Rate reported in several countries. Welfare or commonly social welfare is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Individualists promote the exercise of ones goals and desires and to value independence and self-reliance and advocate that interests of the individual should achieve precedence over the state or a social group while opposing external.

You can add a citation by selecting from the drop-down menu at the top of the editing boxIn markup you can add a citation manually using ref tags. If you are a freelancer you must register for social security with the Union de Recouvrement des Cotisations de Sécurité Sociale et dAllocations Familiales or URSSAF. This page displays a table with actual values consensus figures forecasts statistics and historical data charts for - Social Security Rate.

Individualism is the moral stance political philosophy ideology and social outlook that emphasizes the intrinsic worth of the individual. Because of this not every American is part of the Social Security program and not everyone has a number. Most self-employed social security contributions are tax-deductible.

Tax revenues largely finance government expenses. Social security benefits include old-age survivors and disability insurance OASDI. Bilateral social security agreements.

Payroll taxes in the Netherlands An important part of the social security tax in the Netherlands is associated with employment and the contributions employers and employees must make to this fund. For more information see Additional Medicare Tax under Social Security and Medicare Taxes and Self-Employment Tax in chapter 8. Gun laws and policies collectively referred to as firearms regulation or gun control regulate the manufacture sale transfer possession modification and use of small arms by civilians.

With a focus on Asia and the Pacific ABC Radio Australia offers an Australian perspective. The social security arrangements that Ireland has with other countries can be divided broadly into two groups. On 31 January 2020 the UK exited the EU - this was often referred to as Brexit.

To ensure that all Wikipedia content is verifiable Wikipedia provides a means for anyone to question an uncited claimIf your work has been tagged please provide a reliable source for the statement and discuss if needed. American expatriates who need help with US expat tax preparation overseas taxes foreign tax credit social security issues affecting US. For more information on Additional Medicare Tax.

Agreement and administrative arrangement. You can also register online but you need an activation code from the TGSS and a digital. Countries that regulate access to firearms will typically restrict.

Netherlands United Kingdom USA. Laws of some countries may afford civilians a right to keep and bear arms and have more liberal gun laws than neighboring jurisdictions. Expats in the Netherlands must pay social security.

Sanders Social Security Expansion Act would lift this cap and subject all income above 250000 to the Social Security payroll tax according to a fact sheet released by the senator. She received 80000 in compensation. UK and combining insurance.

The Convention on Social Security between Ireland. Employees pay a social security tax of 1307 of their income. The social security is overseen by the Social Security Bank while employment social security is supervised by the Institute for Employee Insurance.

Exacerbating the cost concern is the fact that workers who are subject to dual Social Security taxation usually receive no additional benefit protection for the contributions paid to the foreign. The Social Security tax rates from 19372010 can be accessed on the Social Security Administrations website. Social security may either be synonymous with welfare or refer specifically to social insurance programs which provide support only to those who have previously contributed eg.

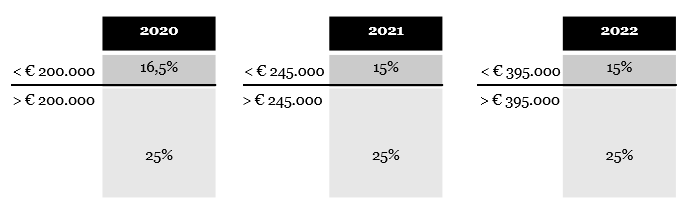

Tax Rates In The Netherlands 2022 Expatax

Payroll Tax Netherlands Safeguard Global

Social Security In The Netherlands Zorgverzekering Informatie Centrum

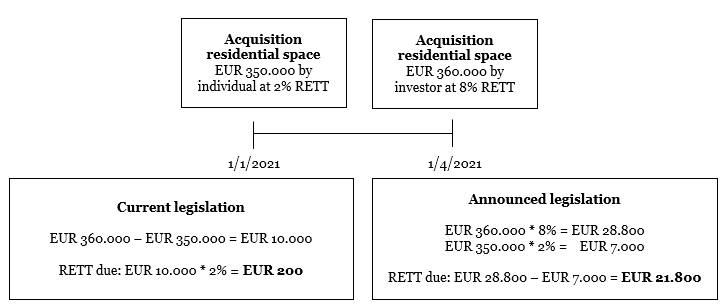

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

Netherlands Economy Britannica

Social Security Tax Netherlands Support For Employers Employees

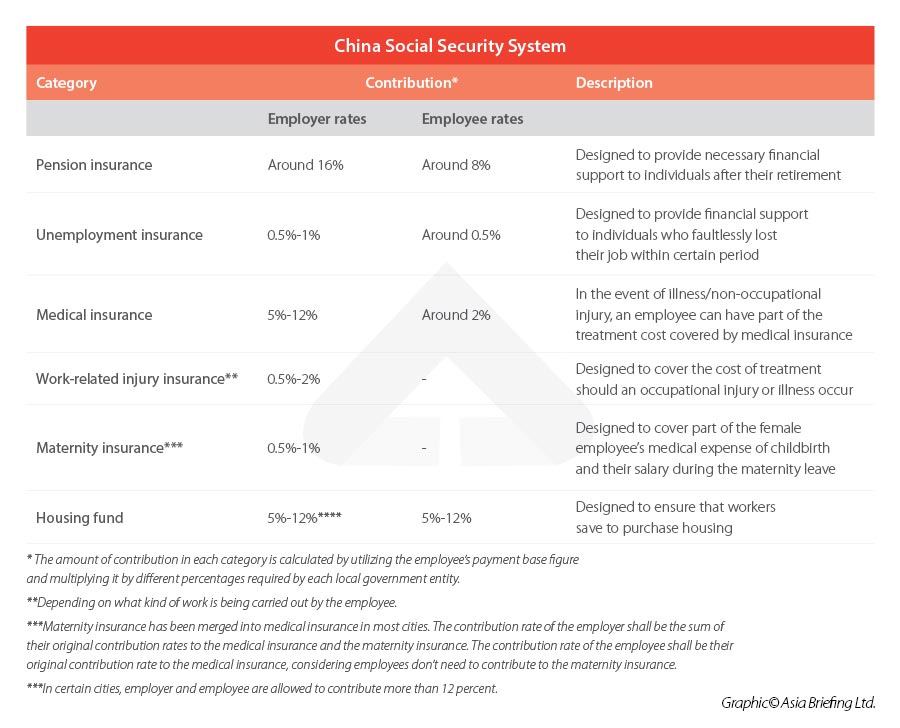

China S Social Security System An Explainer China Briefing News

Payslip In The Netherlands How Does It Work Blog Parakar

Korea Tax Income Taxes In Korea Tax Foundation

Payroll Tax Netherlands Safeguard Global

Netherlands Economy Britannica

Dutch Politicians Call For Probe Into Tax Authorities Handling Of Uber Audit After Uber Files Expose Icij

Us Expat Taxes For Americans Living In The Netherlands

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

How To Read And Understand Your Dutch Payslip Dutchreview

Payroll Tax Netherlands Safeguard Global